Secure your Business legacy

With VEXIT’s expert exit and succession guidance maximizing value, minimizing risk, and ensuring a seamless transition

The question

Is It Time to Secure Your Legacy?

In the United States there are roughly 12 million small and medium-sized businesses, and 52 percent of their owners are 55 or older. Many contemplate retirement and handing the reins over to their children, yet too often they lack the stable, reliable structure needed to protect the value they’ve built.

That raises the question: is it time to sell or to transition your business to the next generation? At VEXIT, we guide owners through a tailored analysis of both options—sale and succession—so you can choose the path that best preserves your company’s future and honors the legacy you’ve created.

What we offer you:

- Maximize your business’s value with expert sale and acquisition support.

- Our succession planning and notary services ensure a smooth, legally sound leadership transition.

- Tailored financial structuring and alternative lending strategies to secure growth capital.

Take our questionnaire and...

Inheritance vs. Sale

Compare different aspects to choose the best option

Pros & cons of Inheritance

You keep the family legacy

Retaining ownership within the family lets you pass on not only the business assets but also the values, brand reputation, and community connections you’ve built over decades. This continuity often sustains customer loyalty and preserves the company’s original vision.

Heirs don't always have interest or capacity

Even with the best intentions, children or relatives may not possess the skills, passion, or time required to run the business effectively. Identifying and developing capable successors is critical to prevent leadership gaps or underperformance.

Possible gradual transition

A phased handover allows you to mentor the next generation while still guiding major decisions, reducing the shock of change and ensuring knowledge transfer. This approach gives both parties time to adapt and align on long-term strategy.

Conflict among heirs

Family businesses can face disputes over roles, compensation, or strategic direction, which can erode trust and derail operations. Establishing clear governance structures, communication protocols, and legal agreements helps mitigate these risks.

Advisory is a must

Complex family dynamics, tax laws, and regulatory requirements make professional counsel indispensable. Skilled advisors craft tailored succession plans, draft trust and estate documents, and facilitate fair, transparent processes.

Pros & cons of sale

Complete retirement

Selling your company offers a definitive exit, freeing you to pursue personal interests or new ventures without lingering operational responsibilities. It can also provide significant liquidity at once.

Could be difficult to find buyer

Locating a purchaser who values your business fairly—and who will maintain its legacy—often requires a broad market search, discreet outreach, and expert valuation to attract serious offers.

Shorter transition

Unlike multi-year family successions, a sale can conclude in a matter of months once negotiations, due diligence, and closing documents are finalized, enabling you to move on more swiftly.

Market is in constant search of stable businesses

Investors, private equity firms, and strategic buyers are continually seeking stable, profitable companies in sectors like yours, which can drive competitive bidding and enhance sale price—especially when your business is well-positioned.

Advisory is a must

From preparing financials and marketing your business to negotiating deal terms and navigating tax implications, seasoned advisors ensure you capture maximum value, structure the sale optimally, and avoid costly mistakes.

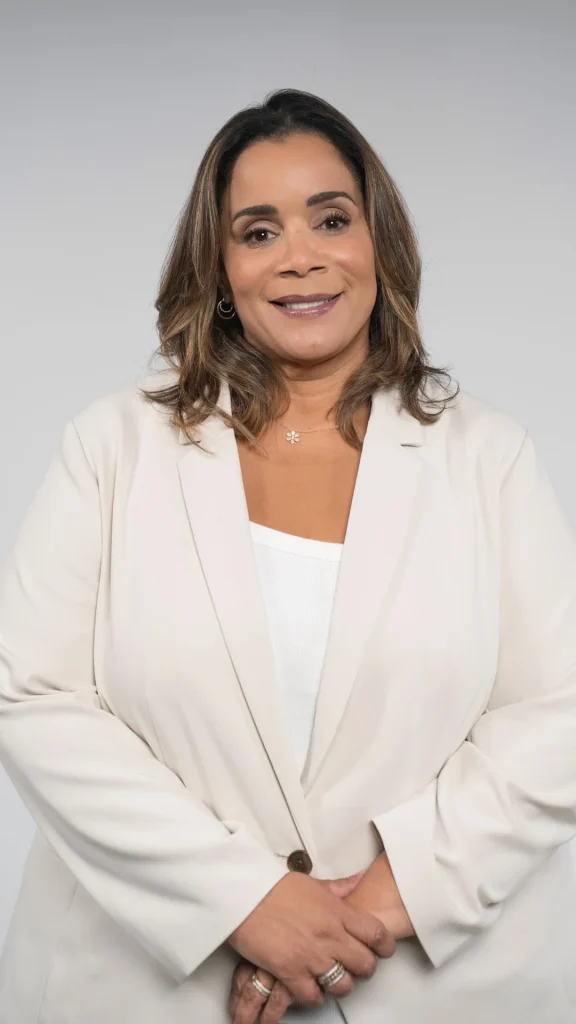

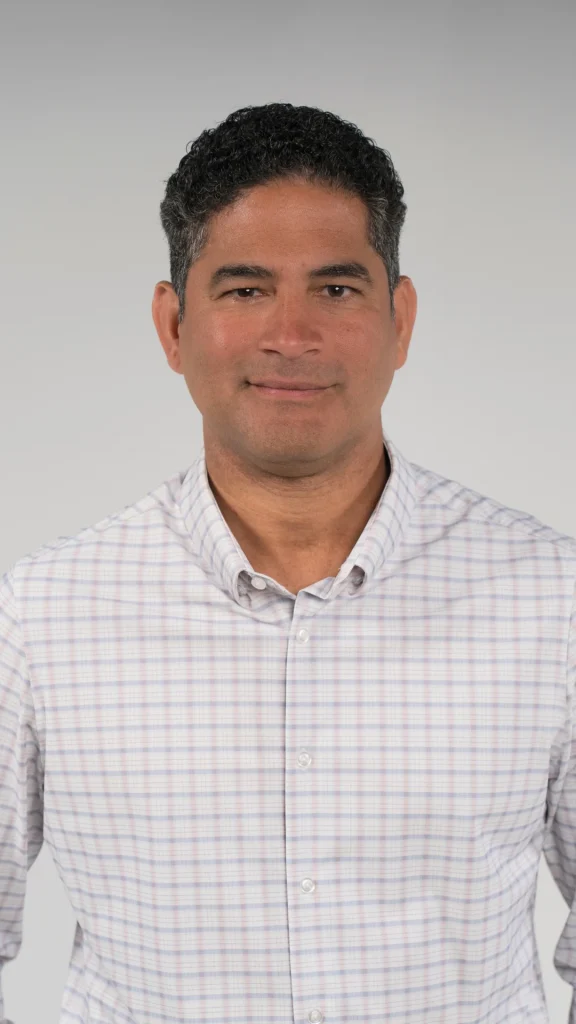

Meet the Team

Ready to take action?

Our seasoned advisors—legal experts, financial strategists, and operational leaders—bring decades of combined experience and a shared commitment to delivering personalized solutions that secure your business’s future.